The provisional 2024-25 Local Government Finance Settlement was published on Monday, 18 December 2023, following a written ministerial statement to the House of Commons by the Rt Hon Michael Gove MP, Secretary of State for Levelling Up, Housing and Communities (DLUHC). It outlines provisional funding allocations for local authorities for 2024-25. This briefing outlines the headlines for London local government and provides commentary from London Councils’ Local Government Finance team.

Key Points

- Core Spending Power (CSP) will increase by 6.5% across England and 6.4% for London boroughs in 2024-25; a real-terms increase of 4.7% and 4.6%, respectively.

- The Council Tax referendum threshold will remain at 3%. Eligible local authorities can set an adult social care precept of up to 2% without a referendum.

- There was no indication the Household Support Fund, due to end in April 2024, would be extended. The fund provides councils with funding to help low-income residents struggling to afford their energy bills and fund emergency food support services.

- Services Grant will be reduced by nearly 85%, down to £77m for England and £14m for London. A proportion is being held back as contingency for any unexpected movements prior to the final settlement.

- The CSP funding guarantee introduced in 2023-24 continues in 2024-25 to ensure authorities receive a minimum 3% increase (before local council tax decisions). Seven London boroughs are expected to receive this funding in 2024-25.

- Public Health and Homelessness Prevention Grant allocations have not yet been announced and are not expected to be announced until the new year.

Core Spending Power

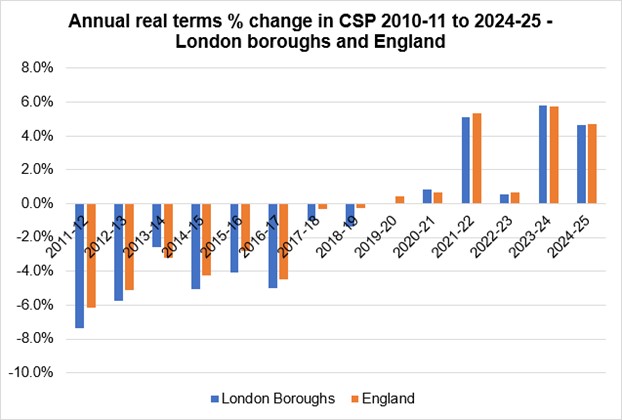

At the England level, CSP will increase £3.9bn nationally from £60.2bn to £64.1bn, a cash-terms increase of 6.5% and real-terms increase of 4.7%. Across London boroughs, CSP will increase by £565m from £8.8bn to £9.4bn, a cash-terms increase of 6.4% and real-terms increase of 4.6%. The chart below shows the real terms change in CSP since 2010-11.

Chart 1 – annual real terms change in CSP from 2010-11 to 2024-25 – London boroughs and England (%)

CSP includes several assumptions and is unlikely to be an accurate reflection of the actual total resources available to local authorities. It assumes:

- All eligible upper tier authorities raise the social care precept to the maximum (2%) permitted.

- All authorities increase overall council tax by the maximum amount permitted.

- Council tax base increases at the same average rate for each authority for the last five years.

- All councils retain their baseline target level of business rates within Settlement Funding Assessment—in reality, some authorities will be above baseline and some below.

Tables 1 and 2 below show the breakdown of CSP at the England and London levels as compared to 2023-24.The key changes to note include:

- Settlement Funding Assessment will increase by 5.7% in 2023-24, with a 5.3% increase for London boroughs to £3.1bn.

- Compensation for under-indexation of the business rates multiplier will total £2.6bn in 2024-25, an increase of £377m in 2024-25, with £450m total for London.

- The Social Care Grant will increase as expected by £692m in 2024-25 to £4.5bn (£114m in London or a 18.5% increase). The majority of this will be allocated using the ASC relative needs formula.

- The Market Sustainability and Improvement Fund (MISF) will be £1.1 bn in 2024. This now includes the rolled in MSIF Workforce fund with total funding levels between the two funds unchanged from 2023-24.

- The ASC Discharge Grant will increase by £200m nationally using the existing IBCF grant formula.

- The Government is proposing to roll over last year’s policy on New Homes Bonus for a new round of payments in 2024-25, which will attract no new legacy payments, similar to the past two years.

- Services Grant will reduce by £406m in 2024-25 to £77m in England, and a proportion will be held back as contingency for any unexpected movements (e.g. within NHB).

Table 1 – Core Spending Power – England 2023-24 to 2024-25 (£m)

|

|

2023/24 |

2024/25 |

£m change |

% change |

Real terms % change |

|

Settlement Funding Assessment |

15,671 |

16,563 |

892 |

5.7% |

3.9% |

|

Compensation for under-indexing the business rates multiplier |

2,205 |

2,581 |

377 |

17.1% |

15.2% |

|

Council Tax Requirement |

33,984 |

36,062 |

2,078 |

6.1% |

4.4% |

|

Improved Better Care Fund |

2,140 |

2,140 |

0 |

0.0% |

-1.6% |

|

Social Care Grant |

3,852 |

4,544 |

692 |

18.0% |

16.0% |

|

ASC Market Sustainability and Improvement Fund |

562 |

1,050 |

488 |

86.8% |

83.8% |

|

ASC Discharge Grant |

300 |

500 |

200 |

66.7% |

63.9% |

|

New Homes Bonus |

291 |

291 |

0 |

0.0% |

-1.6% |

|

Rural Services Delivery Grant |

95 |

95 |

0 |

0.0% |

-1.6% |

|

Services Grant |

483 |

77 |

-406 |

-84.1% |

-84.4% |

|

Adjustments for rolled in grants* |

480 |

0 |

-480 |

-100.0% |

-100.0% |

|

3% CSP Funding Guarantee |

133 |

197 |

63 |

47.4% |

45.0% |

|

Core Spending Power |

60,197 |

64,100 |

3,903 |

6.5% |

4.7% |

Source: DLUHC, PLGFS 2024-25, ‘Core Spending Power: supporting information’ spreadsheet

Note: SFA figures in CSP do not reflect the BRR pilots.

*Includes £115 million allocation of Fire Pension Grant and £365 million allocation of Market Sustainability and Improvement Fund Workforce Fund. For 2024-25, they are included in SFA and ASC MSIF, respectively.

Table 2 – Core Spending Power – London Boroughs 2023-24 to 2024-25 (£m)

|

|

2023/24 |

2024/25 |

£m change |

% change |

Real terms % change |

|

Settlement Funding Assessment |

2,932 |

3,086 |

155 |

5.3% |

3.5% |

|

Compensation for under-indexing the business rates multiplier |

391 |

450 |

59 |

15.2% |

13.3% |

|

Council Tax Requirement |

4,233 |

4,486 |

254 |

6.0% |

4.2% |

|

Improved Better Care Fund |

346 |

346 |

0 |

0.0% |

-1.6% |

|

Social Care Grant |

612 |

726 |

114 |

18.5% |

16.6% |

|

ASC Market Sustainability and Improvement Fund |

87 |

163 |

76 |

86.8% |

83.8% |

|

ASC Discharge Grant |

49 |

81 |

32 |

66.7% |

63.9% |

|

New Homes Bonus |

49 |

50 |

1 |

2.9% |

1.2% |

|

Rural Services Delivery Grant |

0 |

0 |

0 |

0.0% |

0.0% |

|

Services Grant |

89 |

14 |

-75 |

-84.3% |

-84.5% |

|

Adjustments for rolled in grants* |

57 |

0 |

-57 |

-100.0% |

-100.0% |

|

3% CSP Funding Guarantee |

0 |

6 |

6 |

0.0% |

0.0% |

|

Core Spending Power |

8,844 |

9,409 |

565 |

6.4% |

4.6% |

Source: DLUHC, PLGFS 2024-25, ‘Core Spending Power: supporting information’ spreadsheet

Note: SFA figures in CSP do not reflect the BRR pilots

*Includes allocations of Fire Pension Grant and Market Sustainability and Improvement Fund Workforce Fund. For 2024-25, they are included in SFA and ASC MSIF, respectively.

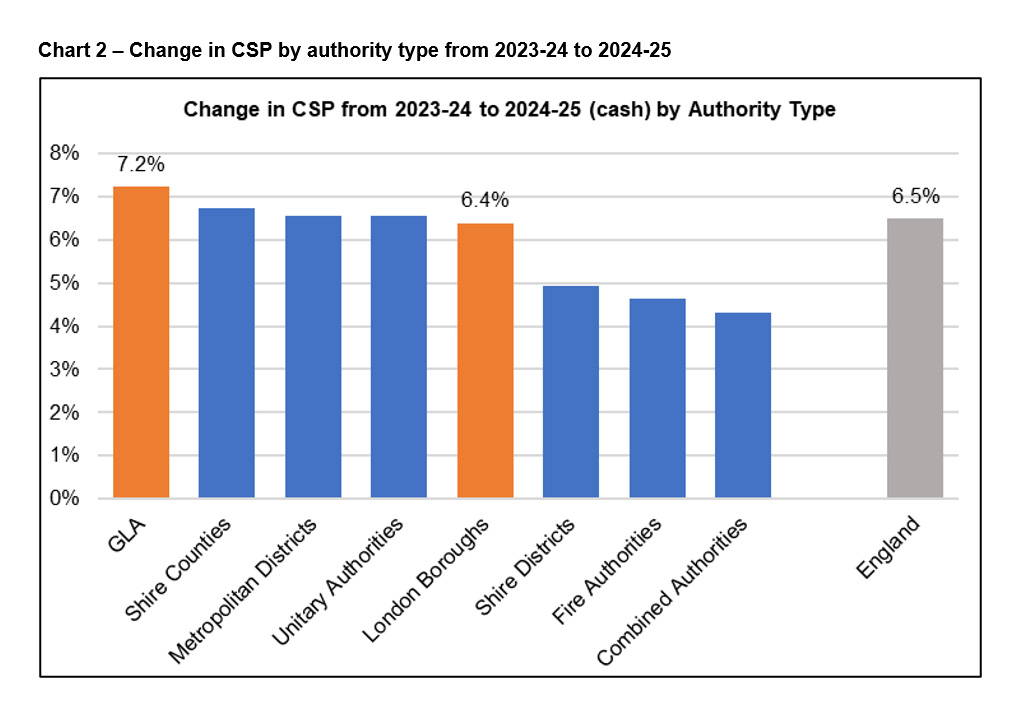

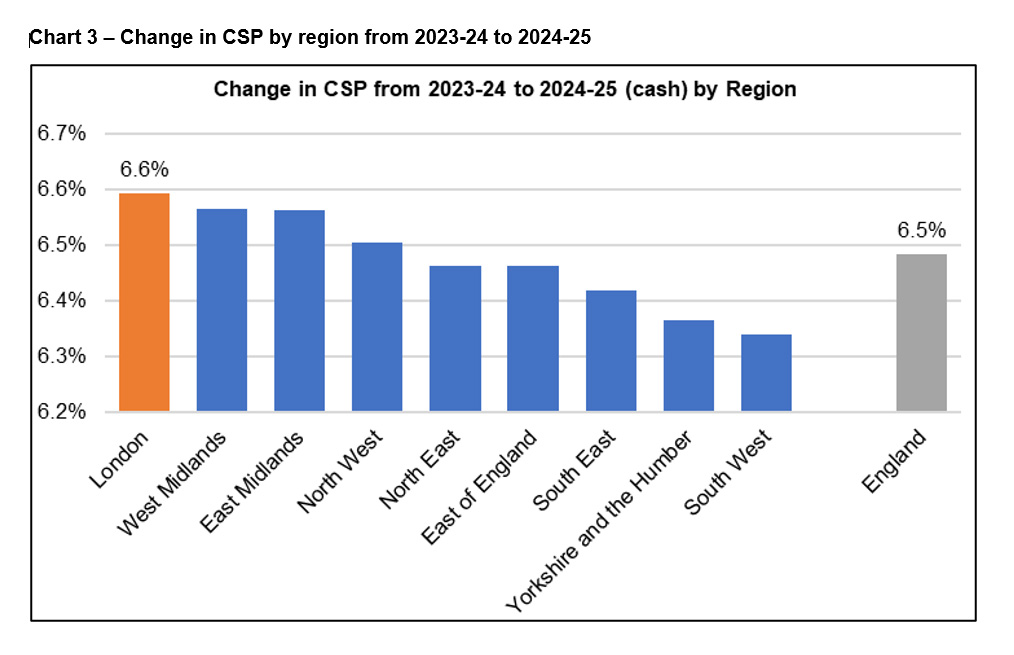

Charts 2 and 3 below show the percentage change in CSP by authority type and region, respectively. As shown, the Greater London Authority (GLA) will see the largest increase in CSP and London boroughs are only slightly below the England average. Regionally, when the GLA is combined with London boroughs, the London region will see the largest CSP increase.

Settlement Funding Assessment

The main changes to distributing core settlement resources in 2024-25 includes:

- Business Rates Retention: The small business rate multiplier will continue to be frozen for 2024-25 at 49.9p while the standard multiplier will increase to 54.6p. Local authorities will be compensated for the shortfall in income for under indexation of the multiplier for the small business rate multiplier via the under-indexation section 31 grant.

- Revenue Support Grant: RSG will be increased in line with September CPI inflation (6.7%). For 2024-25, the Government is proposing to consolidate the Home Office’s Fire and Pensions Grant, worth £115m, by rolling it into RSG.

- Negative RSG: The Government will continue to eliminate negative RSG in 2024-25 (via adjustments to tariffs and top-ups rather than a separate grant).

Council Tax

General principles

The provisional settlement confirms the intention for a core council tax referendum up to 3% in 2024-25 as announced at the Autumn Statement. The flexibility to raise the Social Care Precept will also remain at 2% for 2024-25 for relevant authorities. Again, there will be no referendum principles for Mayoral Combined Authorities or town and parish councils.

Shire Districts will be allowed to raise the main council tax by 3% or £5, whichever is higher. Police and Crime Commissioners, including the GLA charge for the Metropolitan Police, will be allowed increases of up to £13. A 3% referendum principle has been set for all fire and rescue authorities.

GLA precept

On 14 July 2023, the Mayor of London published the draft GLA budget for consultation. The budget assumes there will be one final increase of £20 for TfL, which the Government is again granting in the settlement. For both the police and non-police precepts, the Mayor’s budget assumed a 3% percent limit supplemented by the final £20 increase (at Band D) for TfL. The Mayor will confirm the final precept once he has had an opportunity to consider the provisional local government and police finance settlements.

Business Rates Retention

Compensation for under-indexing the business rates multiplier

As set out above, the compensation for under-indexing of the business rates multiplier will increase nationally by 17.1% to £2.6bn in 2024-25, due in large part to the Government freezing the small business multiplier and extending the Retail, Hospitality and Leisure relief for 2024-25. For London boroughs, this grant will increase by £59m (up 15.2%) to £450m.

Business rates pools

A total of 24 pools have been provisionally designated across the country. London Councils’ Leaders’ Committee agreed in September 2023 not to reconstitute the pan-London business rates pool for 2024-25 as it was, once again, unlikely to provide any financial benefit. Some London boroughs, however, continue to participate in existing pools and there is one new pool containing London authorities.

New for next year will be a business rates pool with Barking and Dagenham and Havering who are pooling with Thurrock Council (the lead authority for the pool). The two existing pools including London boroughs will also continue: The Eight Authority Business Rates pool (which includes Barnet, Brent, City of London, Enfield, Hackney, Haringey, Tower Hamlets, and Waltham Forest); and Sutton will continue to be part of the Surrey and Sutton Business Rates Pool (modified to remove Tandridge and now includes Epsom and Ewell, Runnymede, Spelthorne, Surrey, Surrey Heath, Sutton, and Woking).

Social Care Funding

Social Care Grant

The SCG is increased by £692m which brings the total for England up to £4.5bn. Of these additional funds, £114m will be distributed to London, bringing its total SCG allocation to £726m, which represents 16% of the total grant for England.

To date, the grant has been distributed using roughly 80% need and 20% equalisation. London boroughs would gain significantly more (an estimated £179m in 2024-25 alone) if the children’s social care RNF was used in equal weighting to the adult social care RNF, as boroughs receive a 15% share of the ASC RNF but 25% of the CSC RNF. Because of this unequal weighting, London Councils estimates London boroughs have lost out on nearly £600m of SCG funding since 2017-18. See Table 3 below. London Councils will continue to advocate for both formulae to be used equally in the distribution of this grant.

Table 3 – London’s SCG funding if ASC RNF and CSC RNF were weighted equally (£m)

|

|

2017/18 |

2018/19 |

2019/20 |

2020/21 |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

Cumulative total |

|

Total London SCG |

37 |

23 |

63 |

223 |

277 |

378 |

612 |

726 |

2,341 |

|

SCG if ASC RNF & CSC RNF equally used |

49 |

31 |

84 |

286 |

343 |

472 |

765 |

905 |

2,934 |

|

Difference |

-12 |

-7 |

-20 |

-63 |

-66 |

-93 |

-153 |

-179 |

-593 |

Market Sustainability and Improvement Fund

A total of £1.1b will be distributed for adult social care through the Market Sustainability and Improvement Fund (MSIF), which includes £162m of Fair Cost of Care funding. It also includes £205m MSIF - Workforce Funding, which was a two-year fund announced in July 2023, and will be rolled into the existing MSIF. These represent a £488m increase, and London will receive £162.6m from MSIF.

Commentary

Despite Government plans to increase funding, local authorities will continue to face budget pressures next year as the impact of high inflation and increasing demand for services continues on an unsustainable path. For London local authorities, we still anticipate a funding shortfall in 2024-25 of at least £500m with worrying consequences for local services across the capital.

London Councils asked the Government for a funding uplift of at least 9% – the same as received in 2023-24 – to help them cope with increasing demand for services, high inflation and the impact of years of insufficient funding from central government. Instead, the 2024-25 provisional local government finance settlement increases Core Spending Power by 6.4% for London local authorities (or 4.6% on a real-terms basis).

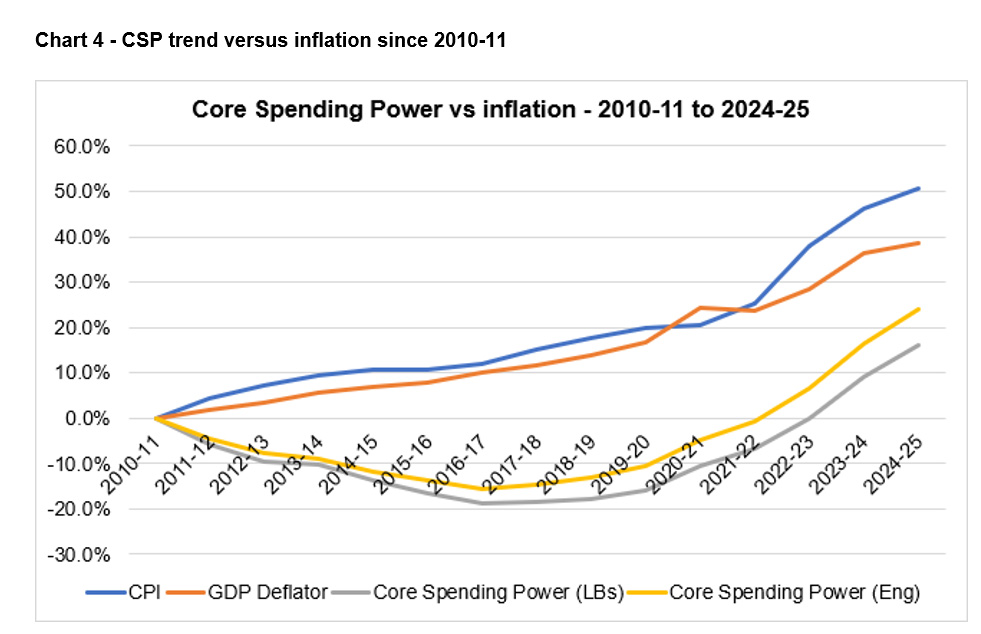

Despite this year’s increase, the long-term trend shows CSP is well below where it would have been had it tracked to inflation. See Chart 4 below.

A real-terms increase in CSP is welcome, but the increase assumes local authorities will increase council tax rates by the maximum permitted amount and this will account for 45% of the £565 million increase for London authorities. Given the ongoing cost of living crisis, increasing council tax on residents is a difficult proposition.

Additionally, demand for services and the cost of providing them have been increasing at alarming rates, well-above the CSP increase. For example:

- Monthly council spending on temporary accommodation has increased by 16% in the past year, driven by the higher cost of securing accommodation and greater reliance on hotels.

- The number of residents owed a homelessness duty is up by more than 15% on last year.

- The number of families living in B&Bs for longer than six weeks is up 781%.

- Despite London’s looked-after-children numbers marginally falling since 2010, expenditures increased by nearly 25%.

- Additionally, we estimate there are £1.1bn of unfunded/underfunded cost pressures London boroughs have to absorb each year (including Council Tax Support schemes, implementing the fair cost of care, and the shortfall in the costs of concessionary fares).

Boroughs have suffered from chronic underfunding for too long. London boroughs’ overall resources remain 18% lower in real terms than in 2010. Over the same time period the population has grown and boroughs now serve 800,000 more residents – broadly equivalent to a city the size of Leeds.

A report earlier this year from the Institute for Fiscal Studies think-tank found London local government funding is 17% lower than its estimated relative need – by far the largest gap of any region in England.

Long-term planning for local authorities remains difficult. As with the previous two years, the provisional settlement has been posted late in December, confirmed funding for only a single year, and several critical grants outside the settlement remain unconfirmed (for example, Public Health Grant and Homelessness Prevention Grant).

In advance of the final settlement, London Councils is urging the government to:

Continue the Household Support Fund. Launched in 2021 in response to the cost-of-living crisis, this provides councils with funding to help low-income residents. Across London, boroughs are spending £136m of the fund this year to help households struggling to afford their energy bills, to fund emergency food support services, and to provide support during the holidays to those who receive free school meals. The Household Support Fund is due to end in April 2024 but boroughs say ongoing cost-of-living pressures mean these resources are still needed.

Deliver longer-term funding for adult and children’s social care. Like councils around the country, London boroughs are grappling with major costs associated with adult and children’s social care. London Councils forecasts a collective overspend in the capital of £350m in adult and children’s social care this year. More funding stability is desperately needed, with a greater focus on prevention to ease the acute pressures on the system.

Reform the broken local government finance system. This must include giving councils multi-year (three to four-year) funding settlements and more devolved powers. Boroughs want to be less reliant on council tax and central government funding so they are better placed to sustain local services and serve their communities’ needs.

Release all of the withheld Services Grant funds in the final settlement. The provisional settlement reduces this funding by nearly 85%, noting some has been held for contingencies in the final settlement.