Key headlines for local government and London

• Household Support Fund – The Household Support Fund will continue at current levels for an additional six months to 30 September 2024.

• Housing: Right to Buy Receipts – The Government is raising the cap from 40% to 50% on the percentage of the cost of a replacement home that can be funded by right-to-buy receipts.

• Housing: Development – The Government is providing £240m for housing developments in Barking Riverside and Canary Wharf and £4m to set up the Euston Housing Delivery Group to support plans to develop up to 10,000 new homes.

• Public Sector Productivity Programme – The Government will provide £4.2bn towards increasing productivity, £3.4bn of which will go to the NHS. Some of the remaining funds will pilot the use of AI to support planning authorities to streamline their local plan development process.

• Public Spending – Departmental resource spending for the years beyond the current Spending Review period (2025-26 to 2028-29) are still planned to increase at just 1% a year on average in real terms.

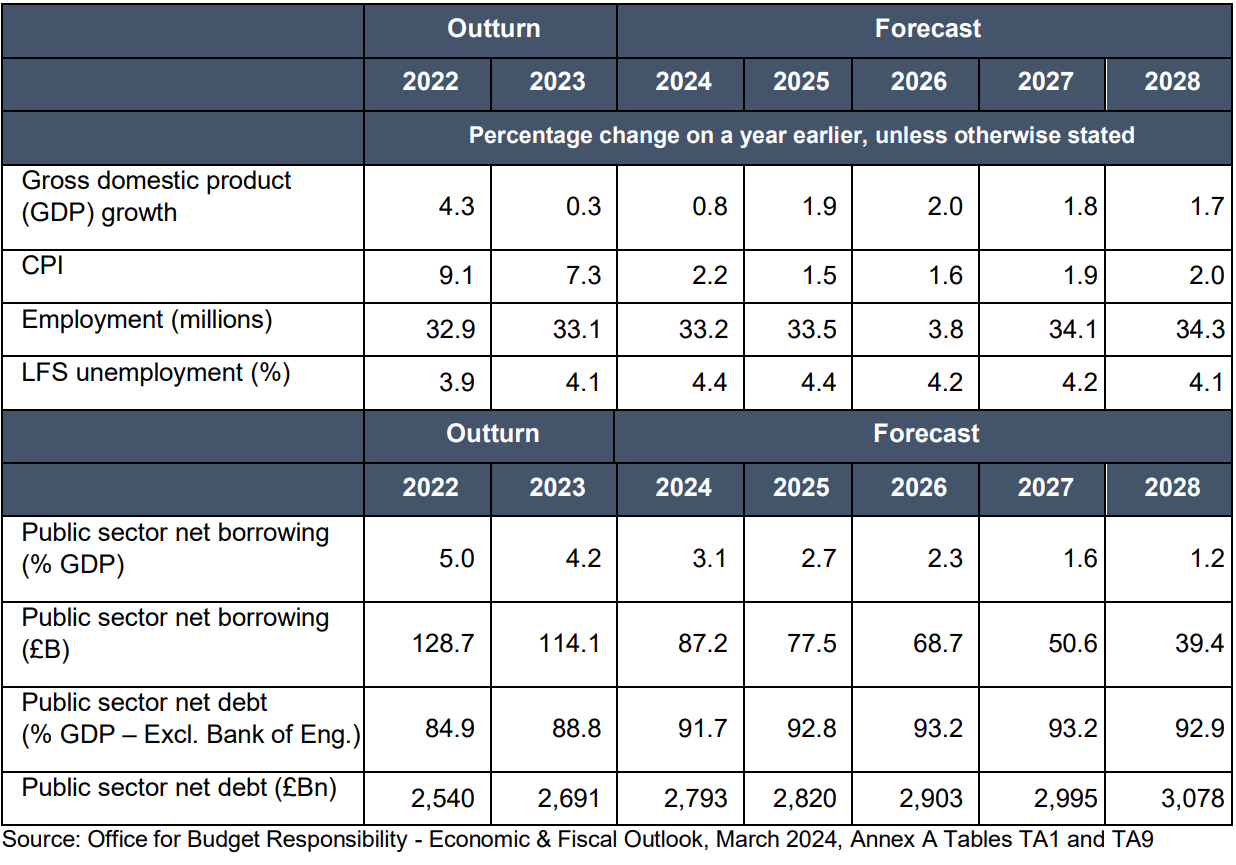

Table 1 – Key Economic & Fiscal Indicators

Key Announcements for London Local Government and Londoners

Public Spending

• Planned departmental resource spending for the years beyond the current Spending Review period (2025-26 to 2028-29) will continue to grow at 1% a year on average in real terms.

• The Treasury stated the next Spending Review would not take place until after the General Election.

• The wider outlook for public spending remains challenging as the planned departmental spending increases mentioned above imply potential cuts for non-protected departments, including local government. Household Support Fund

• The Government announced the Household Support Fund will continue at current levels for an additional six months to 30 September 2024. London boroughs received £136m for the 12 months ending March 2024, so they will receive about half this amount for the six month extension. The fund supports the most vulnerable households with their living essentials, such as food and utilities.

• The Government also stated it will consult on options to better target economic support to households in times of crisis, although the timing and scope is unknown.

Housing

• The Government announced funding for housing development in London: £124m for 7,200 homes in Barking Riverside and £118m for 750 homes in Canary Wharf.

• Building on the Long-Term Plan for Housing announced in July 2023, the Government also announced £4m to set up the Euston Housing Delivery Group to support plans to develop up to 10,000 new homes in London.

• The Government is raising the cap from 40% to 50% on the percentage of the cost of a replacement home that can be funded by right-to-buy receipts.

• There will be a £20m investment in social finance to build up to 3,000 homes and improve capacity for local community groups to deliver housing, but the location of the homes is unclear.

• The Government committed £3m to match industry-led funding for a skills and education programme for local planners in planning authorities.

• The Government will abolish the Furnished Holiday Lettings tax regime from April 2025, subject to the passage of legislation.

Business Rates

• There will be a 40% relief on gross business rates for eligible film studios in England from April 2024 to 2034 (backdated, as this will take time to implement). Local authorities will be fully compensated for the loss of income.

• The Empty Property Relief reset period will be extended to thirteen weeks from 1 April 2024.

• The Government will consult on a “General Anti-Avoidance Rule” for business rates in England.

Local Government Pension Scheme

• Taking effect from April 2024, new annual reporting guidance will require LGPS funds to provide a summary of asset allocation, including UK equity investment, as well as provide 3 greater clarity on progress of pooling through a standardised data return. This will also apply to defined contribution pensions.

NHS

• Funding for the NHS in England will increase by £2.5bn for 2024-25 up to a total budget of £165bn.

• An additional £3.4bn investment will be made into NHS digital infrastructure aiming to improve productivity as laid out in the Long Term Workforce Plan last year.

Adult Social Care

• The budget included £3.5m for two new data pilots for implementing AI in education and improving access to data in adult social care. This is based on the design details of the data research cloud pilots from last year.

• Continued and additional funding was confirmed for the Changing Futures programme, which is using locally led pilots in fifteen areas (including Westminster), to test a person-centred approach to improving outcomes for adults facing multiple disadvantages.

Children’s Social Care and Education

• There will be £45m of match funding to councils to build an additional 200 open children’s home placements and £120m to fund the maintenance of the existing secure children’s home estate.

• Additionally, new proposals will be published later this year to combat profiteering in the sector and explore options of leveraging LGPS funding to unlock investment in new children’s homes.

• With locations to be confirmed in May 2024, there will be £105m for 15 new special free schools that will create over 2,000 additional places for children with special educational needs and disabilities (SEND).

Public Safety & Violence Against Women and Girls

• There will be £75m of funding over three years from 2025 to expand the Violence Reduction Unit model across England and Wales with the aim of preventing violent crime and reducing the burdens on healthcare, schools and criminal justice.

• The Private Law Pathfinder Pilot aims to improve the experience of the courts for victims and survivors of domestic abuse through identifying needs earlier and providing specialised support.

Net Zero

• There will be £600bn of planned public sector investment over the next five years for future growth supporting energy security, net zero and UK’s vital services.

• Landfill tax rates for the year 2025-26 will be adjusted to better reflect actual RPI and ensure the tax continues to incentivise investment in more sustainable waste management infrastructure.

Employment & Business Support

• The Turing Institute, based in London, will receive up to £100m over the next five years. The National Theatre will receive £26.4m to upgrade stages and infrastructure. There will also be a permanent higher rate of tax relief for theatres, orchestras, museums and galleries.

• For SMEs, the Government is renaming and extending the ‘Recovery Loan Scheme’ to ‘Growth Guarantee Scheme’, which is extended through March 2026. The scheme will continue to offer a 70% government guarantee on loans up to £2m. The VAT registration threshold will be increased from £85,000 to £90,000 (but then set to be frozen).

Transport

• The Government is working with Lendlease (the Euston Master Development Partner) and the London Borough of Camden to identify parts of the Euston station site for early release and development. The Government is establishing a Ministerial Taskforce to oversee the next stages of delivery as well as a Euston Housing Delivery Group to explore options to deliver housing opportunities.

Devolution

• The Government announced new Level 4 devolution deals with the North East Mayoral Combined Authority, West Yorkshire, Liverpool City Region, and South Yorkshire Combined Authority, and added new Level 4 powers for West Midlands Combined Authority.

• The Government announced it finalised Level 2 devolution deals with Buckinghamshire Council, Surrey County Council and Warwickshire County Council.

Cost of Living

• The Government will raise the threshold for the High Income Child Benefit Charge (HICBC) from £50,000 to £60,000 from April 2024, coupled with raising the taper cut-off threshold to £80,000. The Government’s ultimate aim is to move this from an individual to a household charge, which they plan to consult on before April 2026.

• The Budget allowed for an increase in the repayment period on budgeting advance loans taken out by Universal Credit claimants from 12 to 24 months. This will apply to new Budgeting Advances taken out from December 2024 and will reduce the cost of monthly repayments.

• Government will maintain the rates on fuel duty at current levels, including the continuation of the previous 5p cut, until April 2025. It will also remove the current £90 fee to take out a Debt Relief Order (DRO), increase the debt value threshold from £30,000 to £50,000, and increase the car allowance for those under a DPO up to £4,000.

• Additional funding, at a to-be-determined amount, will support the processing of increased volumes of disability benefit claims to increase system capacity and meet increased demand.

• The Government extended the duration of the Additional Jobcentre Support pilot for a further 12 months. As part of the pilot extension, claimants will be required to accept new commitments and agree to more work requirements.

Commentary

The Spring Budget has done little to move the dial on the parlous state of local government finances. With the numerous Section 114s issued in the past year and the recent announcement of 19 local authorities receiving ‘exceptional financial support,’ London Councils had called for funding to stabilise the growing financial pressures in homelessness and housing, adult social care and those resulting from supporting a growing number of asylum seekers.

There were, however, some welcome announcements. The extension of the Household Support Fund for a further six months is likely to mean £68m to support residents with the costs of living, but this funding is due to run out just as the winter begins to bite and the last-minute confirmation 5 means it will be difficult for some boroughs to stand up services that may already have been cut from budgets.

The introduction of further Right to Buy receipts flexibility is also welcome as a long-standing London Councils ask, although the raising of the cap from 40% to 50% falls far short of the 100% flexibility that London boroughs desperately need to help increase the supply of affordable housing. The funding for major developments and housing supply in Barking Riverside, Canary Wharf, and the Euston is also very welcome.

However, this Budget is marked by the service areas that did not get mentioned, with nothing announced on homelessness, rough sleeping, temporary accommodation or asylum seekers and refugees. This is in the context where one in 50 Londoners is currently homeless, with boroughs collectively spending £90m each month on temporary accommodation for homeless residents. It is a key pressure in London that urgently needs addressing on multiple fronts, including increased flexibility for the housing benefit subsidy and sustained financial support for Housing Revenue Accounts.

With the Spending Review confirmed to be coming after the General Election, the focus is now on the difficult outlook for public finances. The Institute for Fiscal Studies forecasts unprotected departmental budgets – which account for around a fifth of local government funding – will suffer predicted cuts of up to 3.3% over the next parliament from 2024-25 to 2028-29 from these fiscal decisions.

This analysis is based on the Government’s commitment to grow public spending by 1% each year, balanced against the spending commitments for protected departments such as Defence and the NHS. Borough finances are not robust enough to survive a return to austerity, especially when coupled with rising demand in key service areas like adult and children’s social care and temporary accommodation.

London boroughs have much to offer their residents, but they can only do well if they are given adequate long-term funding, support and flexible policy solutions to succeed. London Councils will continue to make the case for a fair level of funding for London boroughs and for much needed reforms to the local government finance system in the coming months ahead of the Spending Review and general election.