Key Headlines

- CPI inflation is expected to fall sharply to 2.9% by the end of 2023.

- The Government will bring forward a new discounted PWLB borrowing rate to support local authorities borrowing for Housing Revenue Accounts and the delivery of social housing.

- The Energy Price Guarantee will remain at £2,500 until June 2023.

- A series of new childcare measures have been introduced, including the provision of 30 hours of free childcare for all children over the age of 9 months by September 2025.

- Local authorities and schools will receive £340m of start-up funding to extend wraparound childcare provision in schools over 2024-25 and 2025-26.

- Updated devolution deals were announced with the West Midland Combined Authority and the Greater Manchester Combined Authority.

- 100% business rates retention will be expanded to more areas in the next Parliament, alongside wider LG finance reform.

- None of the 12 new Investment Zones - focussing on digital and tech, life sciences, creative industries, green industries, and/or advanced manufacturing – will be in London.

- LB Waltham Forest will receive £8.4m from a £211m fund for 16 high quality regeneration projects.

- The Levelling Up Fund Round 3 has been announced and is planned for later in 2023.

- The function of Local Enterprise Partnerships (LEPs) will be transferred to local government. Support for LEPs will be withdrawn from April 2024.

- Government is consulting on LGPS funds transferring all listed assets into their pools by March 2025.

- A £63m Swimming Pool Support Fund will help public swimming pools with cost pressures and energy efficiency.

- £100m will be awarded to the VCS targeted at organisations most vulnerable to higher delivery cost of services or who are seeing increased demand from vulnerable groups.

Economic and Fiscal Outlook

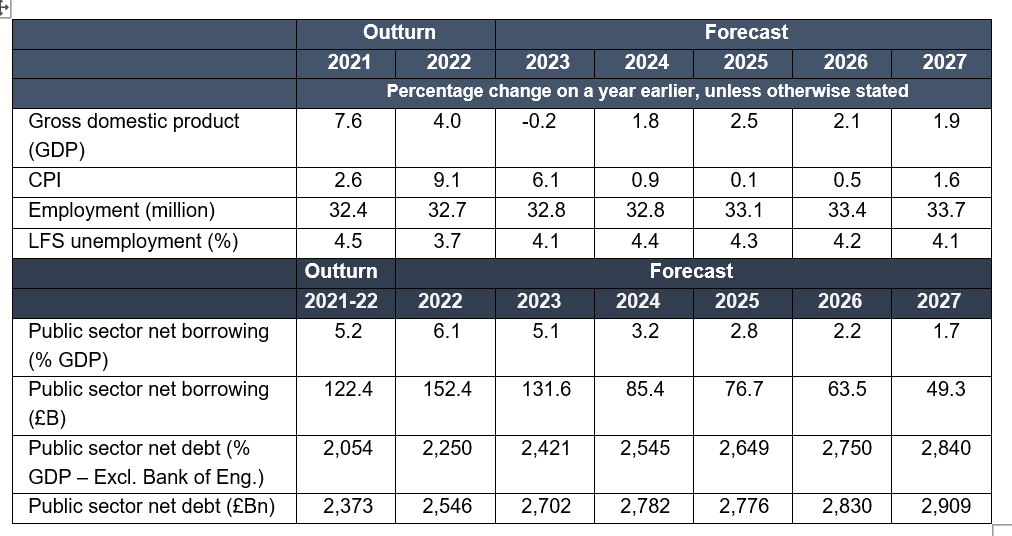

The Office for Budget Responsibility’s (OBR) economic and fiscal outlook has improved since its previous forecast in November 2022 with a shorter, shallower near-term economic downturn, higher medium-term output, a lower budget deficit and lower public debt. However, the energy crisis and persistent supply-side challenges continue to weigh on future growth prospects.

CPI inflation peaked at 11.1% in October and is expected to fall sharply to 2.9% by the end of 2023, a more rapid decline than the OBR expected in November. The drop in wholesale gas prices also means household energy bills are expected to fall below the £2,500 energy price guarantee limit from July and to £2,200 by the end of the 2023.

The limited headroom offered by the improved economic circumstances (though still significantly worse than was predicted at this time last year) has been used to rachet up borrowing which the Institute for Fiscal Studies (IFS) has said gives Hunt a “wafer thin margin of error” to return to a budget surplus in the next few years, and thus also puts pressure on the public finances.

Table 1 Key Economic & Fiscal Indicators

Source: Office for Budget Responsibility - Economic & Fiscal Outlook, March 2023, Annex A Tables TA1 and TA9.

Key Announcements for Londoners and London Local Government

Housing

- The Government will bring forward a new discounted PWLB borrowing rate for council housebuilding from June 2023 at 40 basis points below the standard PWLB interest rate. This is a limited intervention to shore up existing housing supply plans.

Business Rates

- The Government intends to expand 100% retention of business rates to more areas in the next Parliament, alongside wider reform of the local government finance landscape. DLUHC will set out further details in due course.

Childcare

- A series of new childcare measures have been introduced, including the provision of 30 hours of free childcare for all children over the age of 9 months by September 2025. This scheme will be introduced in stages to ensure that there is supply in the market.

- Starting September 2024, local authorities will receive funding to extend wraparound childcare provision in schools – with national rollout over 2024-25 and 2025-26. This totals around £345m.

- For those parents claiming Universal Credit who are moving into the workforce or increasing their hours, UC childcare support will be increased by almost 50%, up to £951 for one child and £1,630 for two children.

Local Government Pension Scheme (LGPS)

- The Government will be consulting on requiring LGPS funds to transfer all listed assets into their pools by March 2025, as well as a separate consultation on requiring funds to consider investment opportunities in illiquid assets to unlock wider investment.

Energy and Net Zero

- The Budget included several measures designed to ease the pressures of energy costs on households. Notably, the Energy Price Guarantee will remain at £2,500 for the next three months. In addition, fuel duty will be frozen for a further twelve months.

- A £63m Swimming Pool Support Fund will help public swimming pools with cost pressures and energy efficiency.

- Energy security was flagged as a long-term solution to securing national growth and meeting Net Zero obligations. Notably, £20bn of funding will be made available for domestic carbon capture, utilisation, and storage (CCUS) projects. Moreover, the launch of Great British Nuclear is designed to encourage growth in the nuclear sector and help to provide a quarter of domestic electricity by 2050.

Levelling up and Regeneration

- None of the Government’s newly selected 12 Investment Zones – nor the Levelling Up Partnerships – being in London.

- In terms of regeneration £211m was announced for 16 regeneration projects and £58m for 3 capital projects. Only one London boroughs received funding for the former, Waltham Forest for £8.4m. It has subsequently been confirmed that these projects were from the previous Levelling Up Fund Round 2 (Round 3 was confirmed at the Budget as well).

- £161m was set out for City and Metropolitan Regeneration Projects to fund high-value capital projects. This is intended for Mayoral Combined Authorities and the Greater London Authority.

- Trailblazer devolution deals were agreed with the West Midland Combined Authority and the Greater Manchester Combined Authority, which have indicated the direction of travel for combined authority deals. They focus on multi-year financial settlements, transport investment, devolution for skills funding, a commitment to business rates retention and strategic direction for affordable housing in the areas.

- The function of Local Enterprise Partnerships (LEPs) will be transferred to local government, and support withdrawn from LEPs from April 2024.

- An additional 30 projects had funding announced under the Community Ownership Fund.

- There will be £100m to support charities and community organisations in England targeted at those organisations most vulnerable to higher delivery cost of services or who are seeing increased demand from vulnerable groups.

Employment

- The offer from the Budget was focused on four main groups outlined below:

- Long-term sick and disabled: Expansion of mental health and musculoskeletal services to help people get back into work, with tailored employment support including expanding the Individual Placement and Support scheme. The Government will also pilot a programme to match individuals with job vacancies.

- Welfare recipients and the unemployed: additional Work Coach support, stricter work search requirements, extended and expanded Youth Offer to assist 16–24-year-olds and additional funds to expand the Staying Close programme to support care leavers.

- Older workers: Reforming pension tax thresholds to discourage workers from retiring early. The Lifetime Allowance charge will be removed from April 2023 and abolished entirely from April 2024. The Annual Allowance will be raised to £60,000.

- Parents: The Budget seeks to improve childcare availability for working parents.

- A new apprenticeship-style programme, called ‘returnerships’ will be introduced to encourage those over the age of 50 to learn new skills and return to work.

- To support young people in employment, the Department for Education will invest an additional £3m over the next 2 years to pilot an expansion of the Supported Internships programme to young people entitled to Special Educational Needs support but who do not have an Education Health and Care Plan.

Welfare

- To support young people leaving residential care into employment, £8.1m will be provided in each of the next two years to expand the Staying Close programme to around half of local authorities by March 2025.

- Qualifying Care Relief (QCR) will be increased to foster carers and shared lives carer.

- The Youth Offer, which provides support to look for work for young people who are not in education, employment, or training, will be extended until April 2028.

Health

- The Government has committed to publishing further details on the NHS Recovery Plan for urgent and emergency care services, targeted at reaching the ambition of eliminating waiting list times above 18 months. It also intends to publish the long-term NHS workforce plan trailed in the Autumn Statement 2022.

- The Government announced the Suicide Prevention Voluntary Community and Social Enterprise (VCSE) Grant Fund worth £10m to help organisations from 2023-24 to 2024-25 to support people experiencing a mental health crisis.

Transport

- An additional £200m will be distributed across England to finance pot-hole repairs. Highway authorities in London will not receive funding from this as they receive a separate funding settlement through Transport for London (TfL).

Commentary

There were some welcome elements in the Budget for London, and for some areas of local government in the devolution space; however, overall, this was a disappointing Budget for London local government.

One of the welcome elements was the offer on childcare, which will benefit working age Londoners with young children. As the Department for Education has previously indicated, London has had historically low take-up of Early Years education, largely due to pockets of significant deprivation, its cultural diversity, and high population mobility. Childcare costs and affordability are the highest in London of any region (full-time nursery for children under the age of two costs the equivalent of 71% of average weekly earnings for inner London residents). Anything that increases access and lowers financial barriers for Londoners to childcare is to be welcomed.

However, the phasing of this and the issues with capacity and supply will be challenging. One of the issues includes how the Government will set the rates for such a large chunk of the childcare market and influence providers, and whether the methods for reviewing this rate will be responsive enough. The difficultly of this has been demonstrated already in local authorities’ experience of the fair cost of care exercise with adult social care providers. It will be important that government designs the implementation of these policies in collaboration with local government.

One small lobbying success was achieved outside of the Budget, with confirmation of Public Health Grant allocations on 14th March not only for 2023-24 but also indicative allocations for next year 2024-25. This does not however, make up for the extremely late announcement of this grant for the coming financial year, which has put a very large strain on local authority public health teams. The 1.3% increase planned for 2024-25 is also far below current inflationary rates and does little to make up for the previous cuts in this sector in the last decade.

Another welcome announcement was the discounted PWLB borrowing rate to support investment in Housing Revenue Accounts. However, apart from this there was almost no support for housing delivery or to support local authorities with the growing homelessness crisis in the Budget. Indeed, there was not a single mention of homelessness, even considering the Government’s stated aim to eliminate rough sleeping by the end of this parliament. Recent research by London Councils found at least one child in every classroom in London is homeless, showing that far more attention and investment needs to be forthcoming to address the housing and homelessness crisis.

The renewed long-term commitment to 100% business rates retention in the next parliament is welcome. However, details were very thin on the ground, beyond the commitment to 100% retention for 10 years within the two trailblazer devolution deals.

The award of regeneration money for projects is directly correlated with many of the bids to the Levelling Up Fund, where London has not fared well, and had a focus on targeting areas outside the capital. This can also be seen in the methodology for selecting the location of the Investment Zones, despite the enormous potential that could be unlocked in areas of London through these zones, and indeed the capital’s significant pockets of deprivation which the policy is intended to target.

Finally, it is disappointing that the £200m of additional funding for potholes excludes London boroughs, with no explanation offered as to why this is the case, despite a huge maintenance backlog on London’s roads.

In summary, while there were some welcome announcements for the sector overall, the Budget offered very little for London local government. The gaps are particularly evident in what this Budget did not mention; namely, on housing and homelessness, but also on adult social care and the wider health integration agenda which barely received a mention.

As the IFS has indicated, with the constrained environment for public spending in the medium to long term, the next Spending Review period, from 2025-26 onwards, is likely to mean tighter purse strings for public spending on the current economic projections. This means a challenging and uncertain medium term financial outlook for London local government.

London Councils will continue to lobby for more resources for London local government and seek a better balance of funding and a broader range of revenue raising powers, to ensure they can continue to deliver vital local services to Londoners.